Author: Ronica Brown | Estimated Reading Time: 3 minutes

My clients often ask me how they can write off their car expenses and pay less taxes.

There’s a lot involved in finding the right answer.

It really boils down to the business use of the car.

You have to look at:

How you’re using the car

How much the car weighs

How you’re tracking your mileage

The nature of your business

The industry in which you operate

Business use of a car is one of those tax deductions that requires careful planning.

It’s also one of the most misunderstood tax deductions.

Here are some key takeaways from this article.

The IRS looks favorably on the business use of a car in industries (such as construction) where such usage is ordinary and necessary for the business operations.

Carefully tracking mileage ultimately determines how you use your car for your small business and, therefore, how much you can deduct in taxes.

It doesn’t matter if the car is in your personal name or your business’ name.

Section 179 is often not always the best option for a business use of car deduction because of its limitations. There are some years where bonus depreciation is the clear winner.

You’re probably trying to learn how to pay less taxes as a business owner.

This article will teach you the best ways to apply the business use of car tax deduction to make that possible.

Use the Table of Contents below to navigate through this article.

What Is Considered Business Use of Car?

Car Salesmen Know How to Trick You

Should You Have Two Vehicles...One for Business Use and the Other for Personal Use?

How to Maximize the Business Use of Car Deduction

Is It Better to Own or Lease Your Car?

A Checklist for Keeping Track of Your Business Use of Car

Should You Buy a Car in Your Business Name?

What Is Considered Business Use Of Car?

The IRS clearly outlines what is considered business use of a car. You can deduct the entire cost of ownership and operation of the car if it’s being used solely for business purposes. But, the deduction becomes tricky when you’re using the car for both business and personal purposes.

Your tax write-off depends on whether you can use the standard mileage rate method or the actual expense method. Regardless of the method used, you must provide irrefutable proof of business usage. Accurate mileage tracking records are crucial!

Here are some scenarios that are considered business use of a car. Remember that deductions can’t be applied for any personal usage of the car. It’s always best to speak with a tax advisor before applying for tax deductions related to the business use of a car.

Driving From Home To Your Office

The only way your drive from your home to your business location can be deducted is if you qualify to claim the business use of home deduction. You only qualify for this if your home office is your principal place of business.

Your principal place of business can be used for administrative purposes if you have another office location. If this isn’t the case, these miles become non deductible commuting miles.

Driving From Your Primary Job To Your Second Job

If you leave your regular job and drive to a second job then those drives count towards business use of car mileage. For instance, you could be a medical doctor who leaves a hospital (primary job) to go to your private practice (second job).

Driving From Home to a Temporary Work Location

Your drive from your home to a temporary location to either meet with clients or conduct business could be deductible. There’s a catch though. Your home must be registered as your primary place of business.

The home office expense deduction is what would be applied here so that you can write-off the miles. Driving to visit clients can also fall under this bucket of mileage.

Driving From Your Place of Business to Other Business-Related Locations

Miles are deductible if you are travelling from your principal place of business. This also increases your car usage. Remember your principal place of business can be your home office if you also claim the home office deduction.

These trips include miles driven for:

Meetings with clients

Lunches/dinners/coffee

Networking events

Driving for Medical or Charity Purposes

This is often overlooked. In general, any personal use of your vehicle is non-deductible. But, you can track miles you travel for medical or charity purposes and possibly claim for those. Your tax advisor can best analyze the situation and let you know whether you qualify for this deduction.

Car Salesmen Know How To Trick You

A car salesman will most likely tell you that you should buy the car in your business’ name and file it under Section 179 when you’re filing your tax returns. This is flawed advice for two reasons:

You don’t get any extra deductions for buying the car in your business name. Instead, you pay more car insurance.

Section 179 may not be best for your tax deduction since you could be better off using another method (such as bonus depreciation) that has more flexibility when it comes to tax deductions.

A lot of business owners will spend money on a car just for the sake of getting a tax deduction. Sure, you have to spend some money to benefit from tax savings.

But, you don’t want to be spending money without a clear tax plan. You’re setting yourself up for an auditing nightmare!

Increasing the business use of your car is the only way to increase your deduction. You have to carefully prove that more of your car usage is for business use than personal ventures. Documentation matters!

Auditors often tackle business use of car tax deductions first because business owners tend not to keep good records of how they’re using the car for business.

The average business owner usually only documents buying the car in the business’ name. Many business owners believe that a car can be written off if it’s purchased in the business’ name even if there isn’t additional documentation. That doesn’t cut it!

The IRS doesn’t care who owns the car. The only thing they care about is how much you use the car for business. Mileage tracking is the only viable way to show evidence of that. I’ll explain more about mileage tracking and other documentation later in this article.

I’ve sat through many IRS audits with clients over the years and all they really want to see is mileage tracking. Registering the car in your business name or having a second car doesn’t release you from this requirement!

Your tax preparer won’t be able to help you in the event of an audit if he or she isn’t asking you about your mileage tracking. In that situation, the tax preparer is expecting you to know the rules.

Car salesmen will also woo you with the allure of your favorite luxury vehicle. There’s nothing wrong with wanting the latest BMW, Audi, McLaren, or whatever luxury vehicle tickles your fancy.

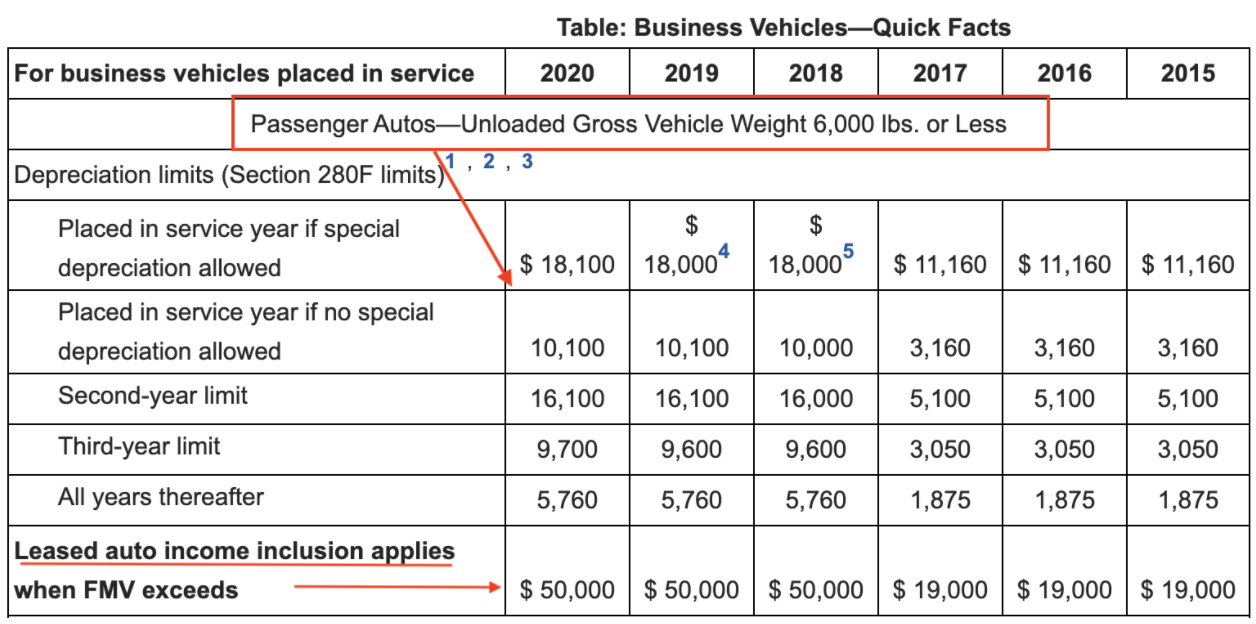

But, there’s a luxury car limit that affects the depreciation expense you can write off on the car. This limit is linked to the car’s weight.

Let’s say you spend $50,000 on a BMW and it weighs 5,000 pounds.

The car’s 5,000 pound weight places limits on how much you can write off because of luxury vehicle rules. The chart above shows these limits. Using Section 179 for this write-off would have made things even worse.

There are two things you can do when you realize your car won’t produce the large deduction you were hoping for in a particular year:

Increase the percentage of business drives and take the write off over 5 years.

Trade in the car and get a new vehicle that meets the requirements outlined in the chart below.

Let’s say you spend $50,000 on a BMW but it now weighs 6,100 pounds. The bigger the car, the bigger the deduction. Some SUVs meet this 6,000 pounds weight category.

In this example, if your business use of the car is 90% then your tax deduction in your first year of purchasing the car would be $50,000 * 0.9 = $45,000. Your deduction will be extremely small in the next four to five years though because you’ve already written off 90% of its value.

The heavier vehicle provides a bigger up-front deduction when bonus depreciation is used. Section 179 fails here since there are still limits to using this method. Never fall for the section 179 hoax from a car salesman or loan officer. Always consult your tax advisor!

Should You Have Two Vehicles...One For Business Use And The Other For Personal Use?

You shouldn’t strive to own two vehicles just for the sake of tax deductions. There are a lot of service-based professionals, like attorneys, who buy a car for personal use and a car for business use.

That’s a waste of money. You don’t need two cars to drive to your office! Think about the value of your deduction on the second car versus how much money you spend. It’s much better from a cost and tax perspective for you to have one car and maximize the business use of it.

It’s better to have one car than to have the financial responsibility of maintaining two cars. That’s the purpose of tax savings; you should save money, not find additional ways to spend it unnecessarily. Only buy a car if it’s absolutely necessary.

How To Maximize The Business Use Of Car Deduction

There are three broad steps to consider when maximizing the business use of car deduction.

Buy the right vehicle.

Use the vehicle primarily for business.

Determine which tax write-off method gives you the best deduction.

I’ve explained the first two steps in the previous section. What we’re going to discuss now are the two deduction methods used by the IRS - standard mileage and actual expenses.

One method may be more favorable than another depending on how much you drive and the age of your car. An important consideration is whether the method you choose can provide a high deduction over a five year period (or over the time you wish to keep the car).

Standard Mileage Deduction

The standard mileage deduction is the most common mileage deduction method because it makes it easier to claim your mileage. In 2021, the deduction was 56 cents for each mile that’s deductible. This amount is adjusted each year.

You basically take the number of miles driven and multiply it by the mileage rate. But, a deduction method being easier doesn’t necessarily mean you’ll get the maximum benefit.

The standard mileage deduction provides a better deduction over time if you drive a lot. Sales consultants, realtors, and other business owners who are always on the road will benefit from this mileage deduction method even in the year when they purchase a $50,000 car.

Let’s say you drive an average of 25,000 miles per year with this $50,000 car. You keep this car for 5 years. Your total deduction over this period will be at least $70,000 which is more than the cost of the car. So, the standard mileage method would be the clear winner once you own the car for the 5 year period.

Actual Expenses Deduction

This deduction looks at the cost of operating a vehicle. Such costs include:

Gas

Repairs

Depreciation

Interest on the car note

Taxes

Tags/Licenses

...plus other costs associated with operating the car.

There may be some years where you have a higher deduction using this method versus the standard mileage deduction method. It’s always best to compute both so that you can identify the option with the most savings. The actual expenses method is most favorable for business owners who don’t drive a lot or for new car purchases.

Your deduction is limited to what you spend when you use this method. Let’s go back to the $50,000 car example. In this case, we’re assuming that all the costs associated with operating the car in the year of purchase amount to $5,000.

So, your total cost is $55,000. Your maximum deduction is $49, 500 in year one if you use this car 90% for business. But, your deductions will only be the cash you spend for gas, repairs, interest on the car note, taxes, tags/licenses, and other car expenses from years two to five.

Remember that you’re using the car 90% for business. So, if you spend $3,000 on car expenses annually from years two to five, you keep $2,700 each year (0.9 * $3,000).

Putting everything together means that your total deduction for the five years would be $60,300.

What If You Use The Actual Expense Method And Then Switch To The Standard Mileage Method?

You can’t switch to the standard mileage method once you have used the actual expense method in the first year. The IRS doesn’t allow this because the actual expense method allows you to depreciate the car.

You can only switch back and forth between both methods if you used the standard mileage method in the first year of using the car for business.

Is It Better To Own Or Lease Your Car?

The decision to own or lease a car is different for each business owner. You do get great tax savings using both options, but the final decision depends on your unique situation. There really is no right or wrong answer; you have to look at your situation to see what fits best.

Pro Tip : Let’s say you’re ready to purchase the car you were leasing. You can write off the amount you paid to own the previously leased car.

The IRS doesn’t care whether you lease or buy the car; you’ll get the deduction for business use of the car either way. But, your choice to lease or buy affects the mileage deduction method you use.

The actual dollar amount of the deduction will be consistent each year if you use the actual expense method for leased cars. You get a large depreciation write off in the year when the car is purchased using the actual expense method. Lease payments are made over the life of the lease so there’s no large deduction in the year you begin leasing the car.

On the other hand, the amount of the deduction will be the same regardless of whether you purchase or lease the car if you use the standard rate deduction method. So, the decision to lease or buy is more of a cash flow and lifestyle decision rather than tax savings.

You have to look at the pros and cons of each option to determine what best suits your needs. Here are some questions that you can consider when making your decision.

How much cash do you have to pay upfront?

A lease normally has less upfront costs.

What will your monthly payments be?

Lease payments are normally cheaper than full purchases.

Can you lease with the option to purchase?

You may pay less for the car if you decide to purchase later on under a lease with the option to purchase.

Do you want to keep your car for the long-term?

Some people like to have a new car every three years so a lease option works better for them.

Do you plan to resell the car?

Let’s say you purchased the car instead of leasing it. You may be able to claim a loss on sale for the lost value of the car when you sell it.

What tax deduction will You get?

You will qualify for both the standard mileage deduction or actual expenses method also when you lease. There will be no large upfront write off since you cannot depreciate a leased car. You can also think about how much you will use the car for business over a five year term to decide which is better for you.

A Checklist For Keeping Track Of Your Business Use Of Car

Use a mileage tracker app to track your business miles. It doesn’t matter whether you have the car in your name or your business’ name.

Create a monthly mileage report that carefully explains your business miles. Have your admin and assistant download these reports from the mileage tracking app.

Keep track of your other car-related expenses such as gas, repairs, and so on.

Include your interest on your car loan when you’re filing taxes.

Click the image below to get a downloadable version of this checklist.

Should You Buy A Car In Your Business' Name?

As I mentioned before, it doesn’t matter whether you buy the car in your name or the business’ name. The biggest concern is how much you use the car for business.

You’ll get all the benefits if the car is used exclusively for business and is registered under your personal name. Similarly, you can get all the deduction benefits using any write-off method if the car is registered in your business’ name.

Let’s say the car isn’t used exclusively for business. You must reimburse the business for your personal use of the car if the car is in your business name.

The rules become a bit muddled depending on your business entity ( LLC, S-corporation, corporation) since you would have to be in compliance with these rules if the business owns the car. Remember, the car belongs to your business (not you) if it’s in your business name.

When Should You Sell Your Car And Claim Losses?

You could claim the loss on the sale of your car if it has been used for business purposes. This is often overlooked during tax preparation.

A business owner has a new car, they remove the old car from the taxes then add the new car. This is tax compliance red-flag. There should be a gain/loss determination on the value of the old vehicle.

Consider this scenario. You:

Bought your car for $45,000

Used the car in your business for five years

Have a total mileage deduction of $25,000

Sold/trade-in the car for $9,000

Your loss in this scenario would be $45,000 - $25,000 = $20,000. This becomes the adjusted cost.

It doesn’t stop there though. You can’t double dip. You’ve already written off part of the value of your car using mileage or depreciation deductions for the business use of the car.

So, the loss on the sale is $9,000 (selling price) - $20,000 (adjusted cost) = $11,000 loss on the sale.

Let’s say you sold the car for $23,000 instead.

Your loss would be $23,000 (selling price) - $20,000 (adjusted cost) = $3,000 gain on the sale.

If there is a gain, then you may want to hold off on getting a new car or find other methods of disposing of the car. A gain is taxable.

Final Words

You can pay less taxes as a business owner by accurately reporting the business use of your car. Don’t make these mistakes:

Buying a vehicle unnecessarily

Buying two vehicles (one for business use and one for personal use)

Ignoring the weight of your new car purchase

Keeping poor records of the business use of the car

Follow the best practices mentioned throughout this article and you’ll reap the rewards of a sizable tax deduction.

Schedule a call with us so that we can help you maximize your business use of car deduction.